Bars: What are consumers looking for?

October 12, 2015Consumers are in search of health & wellness attributes and functional attributes when purchasing bars. We all know Health & Wellness is a major influencer in today’s society, affecting everything from food and drink to fashion, so this is not a big surprise. Plus, consumers who are dieting and/ or exercising have a higher usage of snack bars than the general population, so diet trends tend to influence snack bar innovation. Let’s take a closer look at the Health & Wellness attributes we’re seeing consumers reach for in the bar category.

Download the full report with product examples here!

CATEGORY OVERVIEW

New product introductions for snack/cereal/energy bars in North America are remaining strong with 81% growth in new products from 2009-2014. According to Mintel, US sales of snack, nutrition and protein bars grew 30% from 2009 – 2014 reaching $6.2 billion in 2014. The North American snack bar market has mainly been driven by consumers’ interest in health and wellness. Recent brands have therefore focused innovation around promoting healthy attributes (e.g high protein, fiber and natural ingredients) when launching snack bars. Top growing claims with growth over 100% from 2012-2014 include: Non-GMO, Gluten-Free, Low/No/Reduced Allergen and Ethical-Environmental Packaging.

FLAVOR FOCUS

Flavor plays an important role in the bar category as new products gain their healthy halos and consumers are in search of better-for-you, great tasting products. From 2009-2014, coconut was the top growing flavor with a 525% increase in coconut flavored products. Top coconut flavor combinations include: Coconut & Chocolate, Coconut & Almond, and Coconut & Lemon. Top flavors in the bar category within the same time period include chocolate, peanut butter and almond.

CLEAN/CLEAR LABELS

Consumers are looking for clean labels with easily recognizable ingredients, and snack bars are no exception. Nearly half of all parents (49%) who buy snack bars rate “quality ingredients” and “all natural” as important when selecting which product to purchase for their families.

Nearly half of all parents (49%) who buy snack bars rate “quality ingredients” and “all natural” as important when selecting which product to purchase for their families.

Download the full report with product examples here!

NON-GMO

When Nielsen surveyed consumers around the world for its 2015 Global Health & Wellness survey, it asked them to rate the importance of health attributes of the food they purchase.

- The most desirable attributes reported by global consumers: foods that are fresh, natural and minimally processed.

- 43% consider foods with all natural ingredients and those without GMOs very important. This was the highest percentages of the 27 attributes included in the study.

Looking at bar launches, we see this interest is evident in this category:

- GMO-free claim rose +262% between Jan. 2012 and Dec. 2014 in North America.

- Globally, 16% of 2014 launches carried the GMO free claim, up from 5% in 2012.

LOW SUGAR

Hershey has announced plans to launch a protein bar comprised of meat, vegetables, fruit and grain that has a third less sugar than typical bars to meet consumer demand for low sugar products. One set of consumers concerned about sugar levels is parents: over a third (36%) of parents have concerns about the sugar in snack bars. They have good reason, as in some bars sugar accounts for half the weight of the product. But, despite the level of consumer concern, low/no/reduced sugar claims are not very popular in the snack bar category in North America, with just 8% of all bars launched in 2014 making this claim.

Europe and Latin America have higher rankings, with 15% and 14% of snack bars, respectively, carrying this claim. Lärabar and Kind brands offer low/no/sugar products and saw sales grow significantly between December 2012 and December 2013, suggesting that these types of bars are increasing in popularity because of their low sugar content. The Kind Nuts and Spices range features only 5g of sugar per bar (approximately one teaspoon) and in their first year on the market achieved sales $18million, according to Mintel.

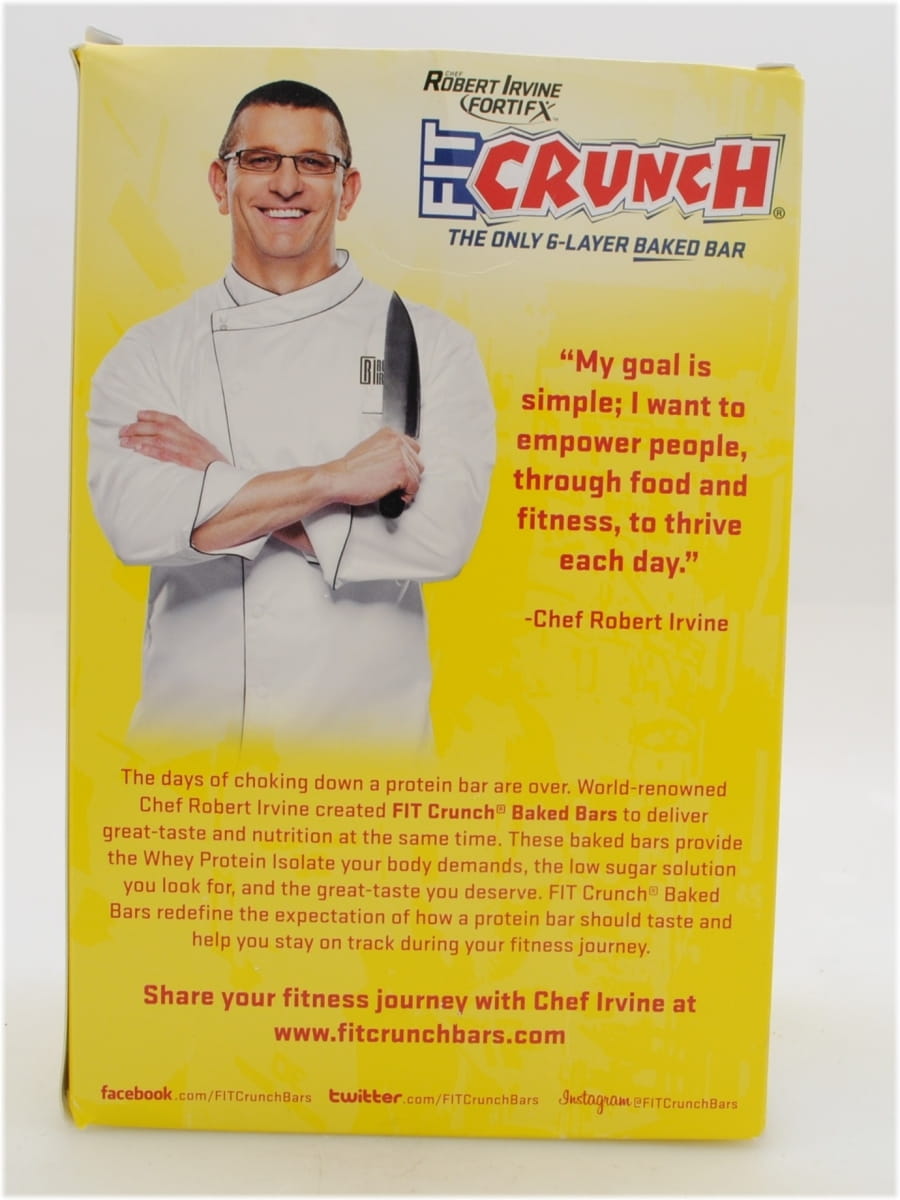

Low Sugar Product Example Description:

This bar is said to be the only six-layer baked bar and is gluten-free and naturally flavored. The layers are: cookie bar, peanut butter, peanuts, high protein peanut butter coating, protein crisps, high protein chocolate coating and high protein peanut butter drizzle. This chef-created, low sugar product contains 190 calories, 16g protein and 3g sugar. The package says the bar dellivers “the whey protein isolate your body demands, the low sugar solution you look for and the great taste you deserve.”

Download the full report with product example here!

ORGANIC

Health & Wellness is the main driver behind organics, with the perception that organic products are healthier being the biggest motivation consumers have for purchasing organic. So, it is no surprise that snack bars with the Organic claim have trended up over the last five years. Globally, the number of snack bars with the Organic claim has more than doubled since 2011. The United States leads the way with 246 products and Germany is number two with 202 organic snack bar launches in this time period.

Nielsen reports that 33% of consumers say organics are very important and the same percentage is also very willing to pay a premium for these products.

GLUTEN-FREE

According to Mintel, 22% of adults indicated in 2014 that they currently eat gluten-free versions of foods, compared to 15% of adults the prior year. Nutrition Business Journal estimates the dollar value of this gluten free ‘tribe’ to be at $20.2 billion in 2015. The bar category is responding to these numbers with an increased production of new products: Glutenfree claims rose +142% from Jan. 2012-Dec. 2014 (89 bar launches to 215).

HIGH PROTEIN & HIGH FIBER

Consumers want weight loss and satiety and look to protein and fiber to help. We see this promoted in Metamucil TV commercials featuring Michael Strahan where he claims avoding junk food, satiety and heart health to be the “Meta Effect” of eating Metamucil fiber snack bars. According to Mintel, 33% of US consumers who eat snack, nutrition and/or protein bars specifically look for products that are high in fiber. This interest rises among older consumers aged 65+. Brands have done well in tapping into this demand in the last year: 25% of the total new product launches were positioned with a high/added fiber claim, an increase of 8 percentage points based on previous year.

33% of US consumers who eat snack, nutrition and/or protein bars specifically look for products that are high in fiber.

The rise of the snacking society has also boosted desire for these claims. Consumers are snacking more than ever due to their fast paced lifestyles and the need to keep up energy throughout the day. As they grab a convenience food to keep them full and provide energy, they’re looking for protein. So, not coincidentally, the snack food category represents the most launches of high protein foods. In 2014, 19% of all high protein foods and drinks launched in the U.S. were snack bars.

In 2014, 19% of all high protein foods and drinks launched in the U.S. were snack bars.

INGREDIENTS MEETING CONSUMER DEMANDS

MEAT

In addition to targeting consumers who want low sugar or savory flavor snack bar options, meat bars also provide options for gluten-free consumers (82% of which do not have a medical diagnosis of celiac disease) and those partaking in the paleo diet which emphasizes high protein and the avoidance of processed grains, refined sugars, vegetable oils, and dairy. Epic brand was first on the meat bar scene with chicken, bison, turkey and lamb jerky/sausage-like energy bars in flavors such as Bison Bacon Cranberry, Chicken Sesame BBQ and Lamb Currant Mint. The company is now expanding to include a line of jerky called “Bites” and a series called “Hunt & Harvest Mix”-- a low carb version of trail mix featuring meat, berries, nuts, and seeds.

Wanting to develop a high protein, low sugar bar, Wilde founder Jason Wright created meat bars he refers to as “savory whole food bars:” glutenfree, Paleo-friendly bars that tastes good and travel well. Wilde stands out in the category because of their flavor profiles (peach barbecue, chili lime, strawberry black pepper and maple bacon blueberry) and cooking process (a slow bake process that retains moisture).

Eating Like a Caveman

Let's talk about paleo for a minute. Nutrition Business Journal estimates that the dollar value of the paleo food tribe is worth $14.6 billion in sales in 2015. More significantly, of all ‘tribes’ (gluten-free, paleo,vegetarian, vegan, raw), paleo has grown the fastest at a CAGR of 25.4% 2010-15.

The UK Telegraph recently covered The Primal Pantry, a UK startup selling fruit and nut bars based on the Paleo diet, saying “British obsession with paleo diet bulks up nut bar sales.” The article says the company “has more than tripled sales in a single year to hit £1.5m, as health-conscious Brits trade in sugary snacks for healthy alternatives.” "It's a hugely popular niche," said founder Suzie Walker. "More and more people are going back to basics and eating clean food." The Primal Pantry’s bestselling flavor is Coconut and Macadamia Nut, which outsells all the other bars two to one, according to the article.

Download the full report with product examples here!

Download the full report with product examples here!

NUTS, SEEDS, ETC.

In addition to dates, figs, fruits and nuts, here are some more ingredients being used to meet consumer demand for healthier bar that are trending in new product introductions:

- Seeds (Chia seeds: Almost 200% increase in bars from Jan. 2012 to end of August 2015.)

- Almond Butter (110% increase in this flavor from Jan. 2012-Aug. 2015.)

- Dark Chocolate (50% increase in this flavor; 171 list it as an ingredient, this number contains a 218% increase Jan. 2012- Aug. 2015)

- Coconut (124% increase in Coconut flavor; 234 products listed it as an ingredient)

CRICKETS?

“Companies like Exo and Chapul are paving the way for such insect-based foods to become mainstream by using culinary flavors and popular formats. Exo sells protein bars in cacao nut, peanut butter and jelly, and cashew ginger flavors. Chapul has a line of cricket bars that include Aztec (dark chocolate, coffee, and cayenne), Chaco (peanut butter and chocolate), and Thai (coconut, ginger, and lime) flavors. Many of these products also appeal to the Paleo diet consumer and are often free of grains, soy, and dairy. Texas based Hopper Foods is a crowd-funded organization that has successfully made cricket flour based snack bars.”

Download the full report with product examples here!

FONA CAN HELP!

Let our market insight and research experts translate these trends into product category ideas for your brand. They can help you with concept and flavor pipeline development, ideation, consumer studies and white space analysis to pinpoint opportunities in the market. FONA flavor and product development experts are also at your service to help meet the labeling and flavor profile needs for your products to capitalize on this consumer trend. We understand how to mesh the complexities of flavor with your brand development, technical requirements and regulatory needs to deliver a complete taste solution. From concept to manufacturing, we’re here every step of the way.

Contact our Sales Service Department at 630.578.8600 to request a flavor sample or visit www.mccormickfona.com/contact-mccormick-flavor-solutions.