A New Day In Breakfast

February 6, 2017Click here for the full report!

A NEW DAY IN BREAKFAST

A host of reasons show that the breakfast category is primed for clear growth and product exploration. A major opportunity in the space: Consumers as a whole are expanding where, what and when they eat breakfast. Add to this a surge in the Millennial and Hispanic populations (a positive sign for breakfast) and an interest in new flavors, formats and ingredients — and there are clear reasons to develop innovative breakfast products. Whether due to demographics, ingredients or shifts in consumer behavior, let’s take a closer look at the specific changes happening for our “most important meal of the day.”

DEMOGRAPHIC CHANGES SIGNAL GROWTH

Of the consumer segment Mintel identifies as “Breakfast Lovers,” more than half are Millennials and nearly half are Hispanic. With growth predicted for both groups, the future looks bright for breakfast.

Millennials (now the largest generation in the U.S.) are more likely than other generations to purchase a variety of breakfast foods at retail. They are expected to grow by 2% in the next five years and are also steadily increasing spending power, family size and influence.

More than 80% of Millennials say that eating breakfast is important for them to keep them full, and the same percentage says breakfast is important to keep them energized. Interestingly, more than half of Millennials tell Mintel they want to see more breakfast pizzas in stores. Other breakfast products being embraced by Millennials include smoothies and portable, on-the-go breakfast options, especially if they fit the perception of clean label.

The Hispanic population in the U.S. also has a great impact on the category, and it will grow by 12% in the next five years. Hispanic consumers purchase breakfast most often at food service locations, which creates a challenge and opportunity for CPG companies. About 81% of Hispanics say that breakfast is important to keep them energized for the day. Hispanics show stronger purchase of indulgent items at retail. According to Mintel, Hispanics prefer restaurant-quality breakfast foods, and they seek out single-serve or handheld breakfast items, such as breakfast sandwiches.

PRODUCTS OF NOTE

Breakfast Best Western Oven Bake Breakfast Pizza

Sweet Earth Get Cultured! Functional Breakfast Burrito

NO BOUNDARIES ON BREAKFAST

Consumers in general are rotating their preferences depending on the day of the week. And many see no reason to keep breakfast as a morning-only meal, or something just for the dinner table. These changing attitudes are expanding breakfast times and types like never before.

Consumers report being pressed for time. That means they are often eating for speed. They’re on-the-go, or eating a quick bowl of cereal before they leave the house. Convenience and portability, for eating in the car or at work rank highly for consumers. According to Nielsen, there is a particular disconnect between the desire to enjoy a filling, nutritious meal first thing and the fact that consumers “do not or choose not make the time to do so.”

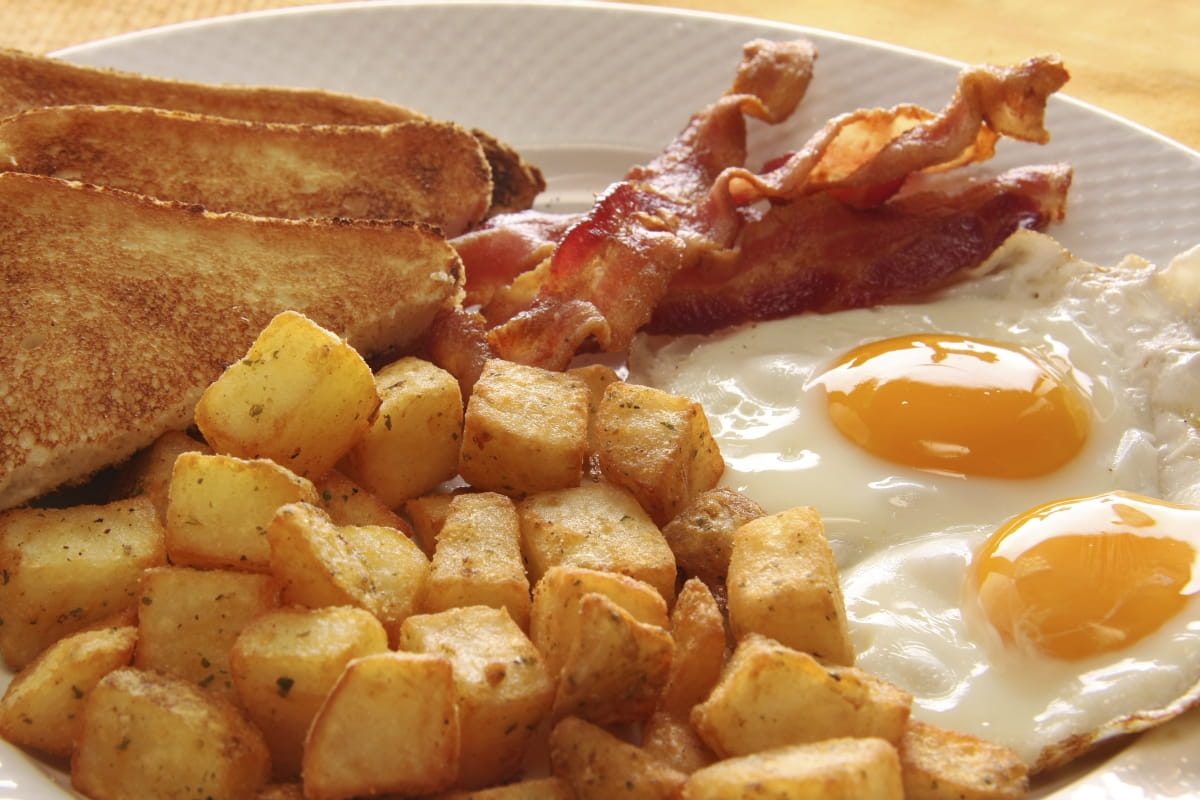

Popular quick breakfast options, like yogurt or protein bars, are often purchased at retail with nutrition in mind, according to Mintel. But while weekdays are for quick nutritious breakfast on the go, weekends are a time to indulge. Consumers are twice as likely to dine out on the weekend. And if they eat a weekend breakfast at home, it’s likely going to be a hot meal and often heavier than what they ate during the week. Weekend occasions are more likely to include both savory and sweet foods, creating an opportunity for food companies across the spectrum.

Also expanding are the actual breakfast meal times. About 32% of consumers tell Mintel they are already regularly eating breakfast foods for lunch or dinner. The biggest food story of 2015 was the addition of all-day breakfast to McDonald’s menu, according to AdAge. Successful breakfast brands can leverage this trend — how can consumers enjoy your product morning, noon and night?

Click here for the full report!

DAIRY-FREE CHOICES, ALTERNATIVE GRAINS AND REDUCED SUGAR

Beyond behavior and demographic changes, there are other trends in breakfast making some waves, and they impact product formulations across the category spectrum. They include a rise in dairy-free options, alternative grains and a reduction in sugar.

GOING DAIRY-FREE

Ripple, a pea-based milk alternative reflects an example of growth and innovation in the dairy-free space. According to Food Navigator, Ripple was made available in 3,000 stores just nine months after launch, and should double that number by mid-2017. It’s said to work great with a morning coffee, unlike some other milk alternatives. Breakfast smoothies are also providing more dairy-free options. Mintel cites a strong rise in the popularity of non-dairy milk/smoothie hybrids. Coconut milk in particular has broken into the breakfast smoothie sector.

PRODUCTS OF NOTE

Ripple Vanilla Plant-Based Milk

Innocent Super Smoothie

SUGAR REDUCTION

Sugar is front of mind for consumers and companies alike, especially when it comes to breakfast. About 38% of consumers tell Mintel that “low sugar” is one of the most important nutrition claims for buying breakfast. In May 2016, the FDA released new requirements requiring added sugar be clearly labeled on the nutritional panel. According to Food Navigator, lawsuits hit major cereal makers in September 2016 dealing with the sugar content in cereal.

PRODUCTS OF NOTE

Kellogg’s Pumpkin Spice Lightly Sweetened Frosted Mini Wheats

Le Pain des fleurs Organic Cocoa Crispbread

NEW GRAINS ON THE BREAKFAST BLOCK

Alternative has gone mainstream. Grains like amaranth, teff, buckwheat and spelt are appearing all over the breakfast category. A recent Shape magazine article recommends eight such grains as oatmeal alternatives to “break out of a breakfast funk.” Also popping up are unique uses for beans, peas, tubers and other plants. With a host of alternative ingredients to choose from, product developers have options to grab consumers looking for that “healthy halo.”

PRODUCTS OF NOTE

Love Grown Strawberry Toasted Cereal

Kind Breakfast Raspberry Chia Bars

NEW FLAVORS WANTED

When it comes to breakfast, taste matters. Consumers cite taste, followed by nutrition, as the most important characteristic for purchase. About 55% of consumers say that restaurant breakfast foods are more innovative than retail foods, but nearly the same percentage says that it is too expensive to dine out for breakfast. This leaves the door open for retail to hit that sweet spot: innovative, high-quality taste that consumers can bring home and fit into their budget.

Adding to the need for good taste is a growing interest in ethnic flavors and new formats, such as breakfast bowls. Nearly two in five Millennials report trying new breakfast food this year, and they are buying a wider variety of products. Flavor is a great opportunity to help meet any taste challenges created by the growing interest in alternative grains, plant-based milks and sugar reduction.

With new behaviors and opportunities at every turn, breakfast could be the perfect spot to try out flavor innovation or new format ideas.

Click here for the full report!

FONA CAN HELP!

Let FONA’s market insight and research experts translate these trends into product category ideas for your brand. They can help you with concept and flavor pipeline development, ideation, consumer studies and white space analysis to pinpoint opportunities in the market. Our flavor and product development experts are also at your service to help meet the labeling and flavor profile needs for your products to capitalize on this consumer trend. We understand how to mesh the complexities of flavor with your brand development, technical requirements and regulatory needs to deliver a complete taste solution.

Contact our Sales Service Department at 630.578.8600 to request a flavor sample or visit www.fona.com.

SOURCES

Mintel Reports, Mintel GNPD, AdAge.com, Shape.com, FoodNavigator.com, Nielsen.com, FDA.gov